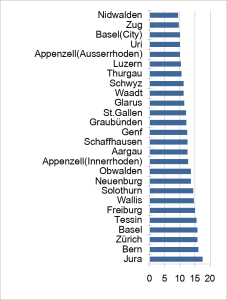

Corporate Taxes in Switzerland (Federal and State/local) 2023 in Percent:

| Canton/Disctrict | Taxes in Percent |

|---|---|

| Jura | 17,42 |

| Bern | 16,01 |

| Zürich | 15,74 |

| Basel | 15,71 |

| Tessin | 15,48 |

| Freiburg | 14,95 |

| Wallis | 14,53 |

| Solothurn | 14,34 |

| Neuenburg | 13,58 |

| Obwalden | 13,54 |

| Appenzell(Innerrhoden) | 12,66 |

| Aargau | 12,48 |

| Schaffhausen | 12,43 |

| Genf | 12,4 |

| Graubünden | 12,06 |

| St.Gallen | 11,92 |

| Glarus | 11,33 |

| Waadt | 11,16 |

| Schwyz | 11,14 |

| Thurgau | 10,45 |

| Luzern | 10,31 |

| Appenzell(Ausserrhoden) | 10,01 |

| Uri | 10 |

| Basel(City) | 9,94 |

| Zug | 9,55 |

| Nidwalden | 9,41 |

Around 10 percent is not so far away from taxation in some EU jurisdiction with a much lower administrative burden. Talk to Us.