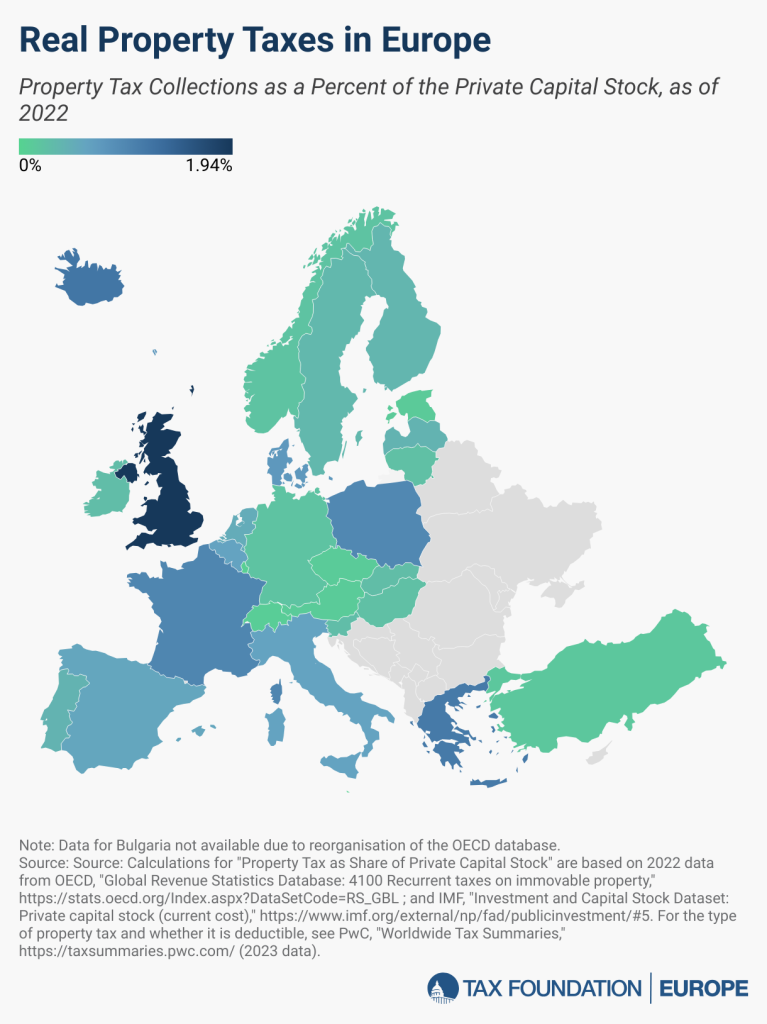

| Country | Property Tax as Share of Private Capital Stock | Real Property or Land Tax | Real Property or Land Taxes Deductible from Corporate Income Tax |

|---|---|---|---|

| Austria | 0.10% | Tax on Real Property | No |

| Belgium | 0.62% | Tax on Real Property (a) | Yes |

| Czech Republic | 0.10% | Tax on Real Property | Yes |

| Denmark | 0.75% | Tax on Real Property | Yes |

| Estonia | 0.11% | Land Tax | No |

| Finland | 0.38% | Tax on Real Property | Yes |

| France | 0.98% | Tax on Real Property | Yes |

| Germany | 0.21% | Tax on Real Property | Yes |

| Greece | 1.13% | Tax on Real Property | No |

| Hungary | 0.25% | Tax on Real Property | No |

| Iceland | 1.18% | Tax on Real Property | No |

| Ireland | 0.29% | Tax on Real Property | Yes |

| Italy | 0.62% | Tax on Real Property | No |

| Latvia | 0.41% | Tax on Real Property | Yes |

| Liechtenstein | 0.00% | None | NA |

| Lithuania | 0.25% | Tax on Real Property | Yes |

| Luxembourg | 0.05% | Tax on Real Property | Yes |

| Malta | 0.00% | None | NA |

| Netherlands | 0.51% | Tax on Real Property | Yes |

| Norway | 0.21% | Tax on Real Property | Yes |

| Poland | 0.95% | Tax on Real Property | Yes |

| Portugal | 0.41% | Tax on Real Property | Yes |

| Slovak Republic | 0.28% | Tax on Real Property | Yes |

| Slovenia | 0.29% | Tax on Real Property | No |

| Spain | 0.58% | Tax on Real Property | No |

| Sweden | 0.35% | Tax on Real Property | Yes |

| Switzerland | 0.08% | Tax on Real Property | Yes |

| Turkey | 0.15% | Tax on Real Property | Yes |

| United Kingdom | 1.94% | Tax on Real Property | Yes |

| United States (for comparison) | 1.80% | Tax on Real Property | Yes |

Property taxes have a long history, dating back to feudal times when they were primarily levied on land and paid by farmers. In contemporary society, these taxes have evolved to encompass a broader range of assets, including real estate, and are paid regularly by both individuals and legal entities. The imposition of high property taxes on both land and structures can have unintended consequences. It may discourage investment in infrastructure, as businesses would face additional tax burdens on any improvements. This can lead companies to seek locations with lower property tax rates to minimize their expenses. Among the 29 European countries examined, Liechtenstein and Malta stand out as they do not impose any recurrent property taxes. Estonia takes a unique approach by taxing only land, which is considered the most efficient form of real property taxation. Of the 27 countries that do levy property taxes, 23 allow businesses to deduct property or land taxes from their corporate income. This policy helps to alleviate the tax burden and encourages business investment. The impact of property taxes varies significantly across Europe. Luxembourg has the lowest property tax revenue as a share of its private capital stock at 0.05 percent, followed by Switzerland at 0.08 percent and the Czech Republic at 0.1 percent. On the other end of the spectrum, the United Kingdom leads with 1.94 percent, followed by Iceland at 1.18 percent and Greece at 1.13 percent. On average, the 29 European countries in this study raise 0.45 percent of their private capital stocks through recurrent property taxes. This stands in stark contrast to the United States, which collects a much higher 1.8 percent of its private capital stock in property taxes. This comparison highlights the significant differences in property tax policies and their economic impacts across different countries and regions.

Most countries seem very moderate compared to the US. Real estate taxes in the United States play a crucial role in local government funding and significantly impact property ownership costs. These taxes vary widely across the country, with Hawaii boasting the lowest average effective property tax rate at 0.27% and New Jersey claiming the highest at 2.23%. However, it’s important to note that rates can fluctuate within states depending on specific local jurisdictions. The calculation of property taxes typically follows a straightforward formula: Fair Market Value × Assessment Ratio × Tax Rate = Property Tax. This seemingly simple equation can result in vastly different tax burdens for homeowners across the nation. The Tax Cuts and Jobs Act has further complicated matters by limiting state and local tax (SALT) deductions, including property taxes, to $10,000.

To alleviate some of the tax burden, certain states offer exemptions that can reduce a property’s taxable value. These exemptions vary by jurisdiction and can provide significant relief for homeowners. Despite these potential breaks, property taxes remain a primary source of revenue for local governments, funding essential services such as schools, public safety, and infrastructure improvements.

The disparity in property tax rates across regions has a profound effect on homeownership costs. In some areas, annual property tax bills can rival or even exceed monthly mortgage payments, making it a crucial factor for potential homebuyers to consider. Some states have implemented assessment limits to control property tax growth. California, for instance, has the strictest cap at 2% per year for all property, while Florida limits homestead value increases to 3% annually. While these caps can provide stability for long-term residents, they often result in newer homeowners paying higher taxes for similar properties, creating a system of uneven tax burdens within communities. Understanding the complexities of real estate taxes is essential for both current and prospective homeowners in the United States. These taxes represent a significant ongoing cost of property ownership and can vary dramatically based on location, making them a critical consideration in real estate decisions across the country.

What has been said about Spain? It is like Florida without the crime…

What is your backup plan? Talk to us.