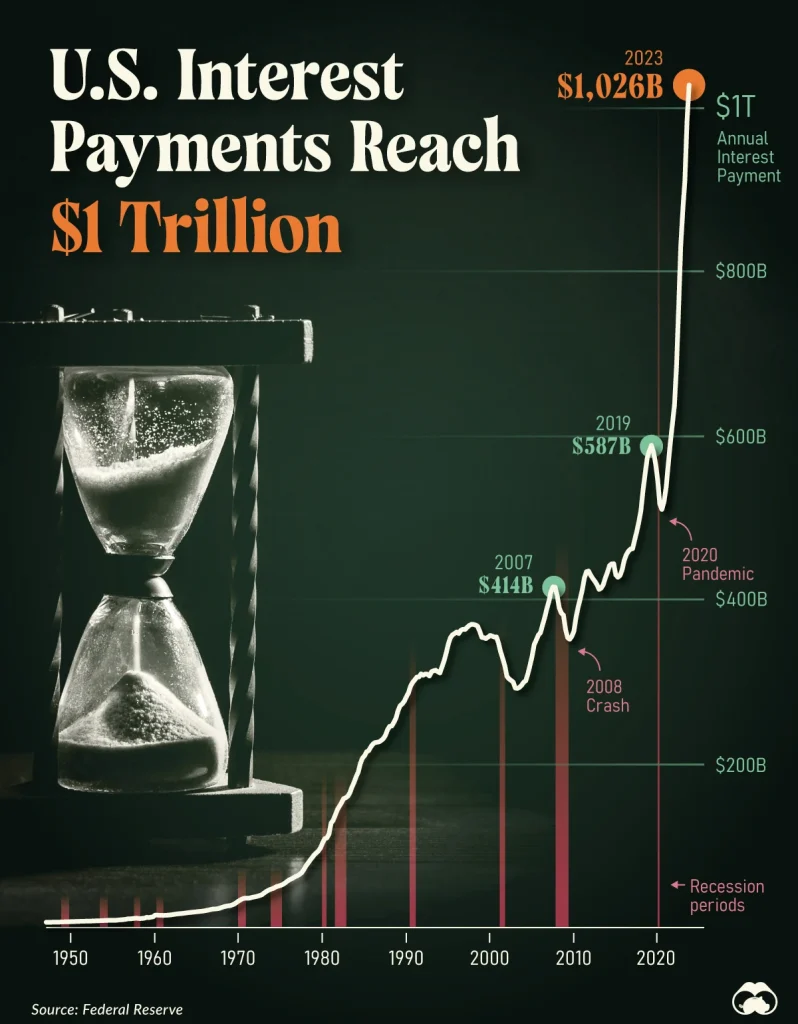

US interests payments have reached 1 Trillion USD per year. 1 Trillion equals 1000 Billions.

Picture Source: Visual Capitalist.

Why the Dollar Will Lose Its Status as the Global Reserve Currency

The United States dollar has long been the world’s reserve currency, a position it has held since the end of World War II. However, this status is not set in stone, and history has shown that reserve currencies are eventually displaced when the rest of the world loses confidence in them. I believe that the dollar’s days as the dominant global currency are numbered, and that its decline is inevitable.

There are several indicators that point to a waning confidence in the dollar. First, we have seen a decline in the dollar’s use in international trade. More and more countries are seeking to conduct trade in other currencies, such as the Chinese yuan or the euro. This reduces the demand for dollars and weakens its position.

Second, foreign central banks have been steadily reducing their holdings of US dollars. They are diversifying their reserves into other currencies and assets, a clear sign that they are losing faith in the dollar. This trend is likely to accelerate as more countries seek to reduce their exposure to the US currency.

Third, world leaders have been increasingly vocal in their calls for a move away from the dollar. French President Emmanuel Macron has been urging Europeans to seek financial independence from the United States, and leaders from countries such as Russia, China, and Iran have expressed openness to moving beyond the US dollar in international trade.

The loss of the dollar’s reserve status would have significant implications for the US economy and government. It would make it more difficult for the US to finance its budget deficits and would likely lead to higher interest rates and inflation. The US government would also lose the ability to use the dollar as a tool of foreign policy, as it has done in the past with sanctions and trade restrictions.

In conclusion, I believe that the writing is on the wall for the US dollar. Its decline as the global reserve currency is inevitable, and the only question is when it will happen. The US government and the American people need to prepare for this eventuality and take steps to mitigate its impact on the economy and the country’s standing in the world.

Pic Source CCO

Another De-Dollarization Bombshell: The Coming of BRICS+ Decentralized Monetary Ecosystem

The current international monetary and financial system, dominated by the US dollar, is dysfunctional and in need of reform. The BRICS nations, comprising Brazil, Russia, India, China, and South Africa, are taking the initiative to address the flaws in this system and create a more equitable and decentralized monetary ecosystem. This shift towards de-dollarization is a significant development, as it challenges the long-standing dominance of the US dollar and paves the way for a more multipolar global economy.The BRICS nations are working together to establish a decentralized monetary system, anchored in physical gold and BRICS+ currencies. This system, known as Unit, is designed to be academically sound, technologically innovative, and complementary to the existing banking infrastructure. The New Development Bank (NDB) and BRICS+ are set to embrace the concept of Unit, which will help it become the pinnacle of the new emerging global financial infrastructure, free from malign political interferences.The implications of this shift are far-reaching, as it will allow each sovereign economy to develop along its optimal path, unencumbered by the constraints of the current system. The end of the nation-state and de-industrialization are also expected to be significant consequences of this shift. The global South, particularly, is expected to benefit from this new financial infrastructure, as it will provide a more equitable and sustainable means of economic development.In conclusion, the coming of BRICS+ decentralized monetary ecosystem marks a significant turning point in the history of international finance, as it challenges the dominance of the US dollar and paves the way for a more multipolar global economy.

What is your Backup Plan?